What would going in to administration mean for a club like Everton?

With Premier League football having been assured for another season, you might have thought that Everton supporters might have been allowed the luxury of exhaling for once. The club’s 70th consecutive year in the top flight will not be marked by falling from it. The last game at Goodison Park will not be in the Championship. The Toffee-inclined could finally unclench their shoulder muscles and relax for a few weeks now, couldn’t they?

By Ian King

Well, because this is Everton…not quite. The end of the season has been marked by a fresh flurry of activity concerning the parlous state of 777 Partners, the company who have been both putting money into the club and trying to complete a takeover for the last eight months. The rumours and questions concerning this company, it turned out, were pretty much on the nose all along.

With that takeover attempt now having pretty much collapsed, Everton remain very much where they were; a football club hundreds of millions of pounds in debt and with a not-quite-finished new stadium to complete find themselves at a crossroads of their own making. The dread word at such a point is ‘administration’, but what does this mean, how likely is it for a club the size of Everton, and what might its ramifications be?

When we talk of ‘entering into administration’, we’re talking about a specific legal process in the UK. First introduced under the Insolvency Act 1986, it occurs when a business becomes insolvent, meaning that it can no longer meet its debt obligations as and when they fall due. A licensed insolvency practitioner (IP) is appointed to either restructure the business and come to an arrangement with creditors, sell off assets and pay off creditors or, if no means can be found to do so, liquidate it.

While the IP’s main aim is to rescue the business, their first responsibility will be towards creditors. The normal way to exit administration is through a Company Voluntary Arrangement (CVA). Under a CVA proposal, a dividend (or partial return of debt) would be made to creditors.

A formal meeting is called by the IP at which creditors get the opportunity to vote on the proposal. To approve it, creditors must vote in favour, with a requirement of 75% support by the amount owed. The implication of getting to this stage is that the only real alternative is liquidation, which often results in smaller and unsecured creditors receiving little to nothing. This is why CVA proposals for just a few pennies in the pound are often accepted; the alternative would often – almost always – be zero.

But all creditors are not created equal. Secured creditors are required to be paid in full, while since December 2020 HM Revenue and Customs (HMRC) have also been a secondary preferential creditor for outstanding VAT, PAYE and National Insurance payments. More controversially, football itself has also long considered itself to be a preferential creditor; the game’s rules insist on all ‘football debts’ being paid in full.

All this dry legalese can make the administration process sound like a breeze, but its costs should not be understated. The ongoing existence of the club would be at risk. Work on the new stadium would almost certainly have to be paused. Redundancies are likely-to-inevitable. Everton have around 900 staff in total, which would have to be reduced. The wage bill would have to be savagely cut. Players could either rip up their contracts and become free agents or stay and find their value as a saleable asset having plummeted. And administration hurts smaller (and often local) businesses more than most. Small traders have no say over the process and often receive little to nothing by way of a dividend payment.

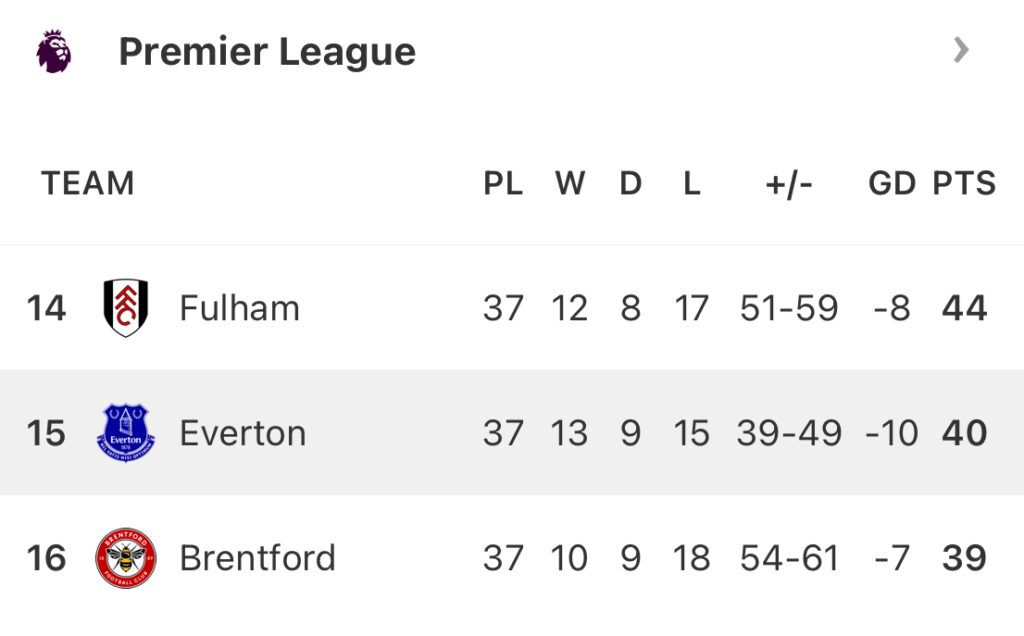

This can leave a sour taste in the mouth, especially when ‘football creditors’ (mostly players, coaching staff and clubs) are guaranteed payment in full while secured and preferential creditors get most of what they’re owed too. The club would also be docked points. In this case, Everton would be docked nine next season just for having declared insolvency in the first place.

The larger a business is, the more complex administration tends to be, and at Everton there’s the further complication of that new stadium, so much remains uncertain. But what can be said with a reasonable degree of confidence is that the very large numbers being casually thrown around at such times can be way out. When IPs get into a failing football club’s finances, it is not uncommon for the condition of the accounts to be even worse than originally believed.

For these reasons, Everton supporters getting spooked on a daily basis by mildly frightening media headlines should remember that administration remains rare among football clubs. There are good reasons why, especially considering their well-established habit of spending more money than they earn, only one Premier League club (Portsmouth, in 2010) has previously taken this step.

And it says something for everything that we know about 777 Partners that administration may even be a preferable alternative to them taking ownership of the club. The reviews from some of the other clubs in their portfolio have been pretty dismal. The costs of all this mismanagement may end up borne by the fans, staff and small creditors, while those who put them in this position in the first place will walk away without having suffered any major consequences. Ever, the cynical among us might conclude, was it thus.

(Images from IMAGO)

You can follow every Premier League game with FotMob — featuring deep stats coverage, xG, and player ratings. Download the free app here.